OEMs - providers of individual machine modules or complex machines / systems - have the know-how to offer machine users the key functions as the most important differentiating feature in an economically successful manner, and to expand these functions to include digital IIoT components and services.

Digitalisation of production systems: Getting smart while keeping out of harm’s way?

The topics of digitalization / IIoT of production systems are omnipresent in the general reporting media, as well as featuring heavily in the specialist media. More and more new keywords are emerging in the process. Companies such as Amazon and Uber are often cited as examples, demonstrating to the whole world how digitalization strategies can be used to achieve economic success through the consistent digitalization of online trade and logistics (Amazon) or through the digitally mediated use of existing resources (Uber). Consequently, OEMs of capital goods are also asking themselves: Can we achieve similarly rapid success with digitalization, and if so, how?

First of all, the topic of digitalization / IIoT for production systems needs to be further narrowed down. We will consider possible digitalization steps along the typical machine lifecycle (VDMA) or, more precisely, only those measures that relate to products, services or other performances that can be offered to an end user. We will not consider entirely new technologies and business models which are technically conceivable, but currently have no legal framework (such as machine-to-machine order and payment, for example). One fundamental aspect should be mentioned in advance. Some experts question whether digitalization and IIoT technologies in mechanical and plant engineering have any potential at all to bring about fundamental or even disruptive changes in existing business models. As the author, business angel and former CTO of IBM, Dr. Gunter Dueck, comments in this context: "When the Deluge comes, build ships, not dikes ... Are we building ships to set sail to the digital future continent? That would mean that we are looking for digital innovations that would shape our new age”.

"We will definitely remain mechanical engineers"

A study "Digitalization in Mechanical Engineering" by the Hans Böckler Foundation in 2018 sizes things up in more concrete terms and quotes an expert from a German company: "We will definitely remain mechanical engineers and not become a software house." But we need software and networking to sell our machines better and make sure that they remain attractive. Based on digitalization, we want to help customers to solve their problems better. "Above all, we want to leverage the digital potentials to ensure that no one comes between us and our customers. This is a forward strategy, coupled with a hedging strategy, so that no disruptor - Amazon, Google, Microsoft or similar players - ends up alienating us from our customers". In the final instance, competitive pressure leaves OEMs of capital goods no other option: they must face up to the emerging digitalization! So, it is not a question of whether, but how. The current state of digitalization and the necessary priorities in mechanical and plant engineering, however, are assessed quite differently by the parties involved. The IMPULS Foundation of the VDMA, for example, summarized the state of affairs in the foreword to a 2016 study as follows: "Industry 4.0 has arrived in German mechanical and plant engineering. Companies are taking a leading role, especially as providers of digitally networked technologies and services ... For customers around the world, additional added value is being created”.

Gunther Kegel, Chairman of the Board of Pepperl+Fuchs and current ZVEI President commented as follows in an interview in June 2018: "However, I do think that ... our pace moving forward is rather slow. The possibilities are so diverse that we have to choose very consciously for which of the many resources are used, degrees of freedom are allowed and perhaps something new will be established. It has to be weighed up what has to be implemented and what not yet, because it still seems too far away." The statements show how differently the situation in mechanical engineering is assessed by the actors themselves. At the end of 2019, Commerzbank AG attempted a quantitative assessment of digitalization in the German mechanical engineering industry: "A decisive development towards the digital company is the integration of platform solutions, both at the process and service levels as well as at the sales level. In the meantime, three out of four companies in the sector state that such IIoT platforms are important for them, and almost 30 percent are already using corresponding solutions". This means that more than half of the German machine and plant manufacturers had not yet taken any action on the topic of digitalization / IIoT. The situation is similar in other countries with a comparable mechanical engineering industry.

Success patterns for digitalisation

As an OEM for production systems, it is important to identify the most important players in the field of digitalisation / IIoT in the industry - and consider their role, capabilities and interests (see also VDI/VDE Status Report [9]):

Moreover, digitalization in the field of capital goods cannot be viewed as an isolated trend, but must be embedded in key current trends. The most important ones are:

Industry 4.0 / industrial production of individual products - End users expect an increasingly high variability of manufacturing systems: it must be possible to manufacture the widest possible range of products in small to medium quantities harnessing the same system.

Production plants must be scalable and offer options for cost-effective subsequent expansion of existing systems in terms of capacity and output.

Declining OEM margins on new installations combined with high end user expectations for maintenance and service make the expansion of LCC-based business models (LCC = Life Cycle Costs with new business concepts (including maintenance, service, retrofit services, e.g. "Predictive Maintenance") more and more economical for OEMs as well, and therefore more meaningful.

Users' expectations of the interoperability of machine modules and sub-systems are constantly on the rise; machines and machine modules from different suppliers should be as easy as possible to combine in a single production line. This results in greater comparability and tougher competition for OEMs. All these requirements can only be reconciled very efficiently in machine and plant construction, both in technical and economic terms, if production systems are consistently modularized, scalable in various stages of expansion and, in the final instance, also networkable. Only with modular networked machines will one be economically successful in the long term - more details are described in the HARTING article on modularization: "How granular can production technology be?"

Since the economic success of digitalization in the mechanical engineering industry can vary greatly from segment to segment, and depends among other things on company focus and business models, we will not make any recommendations here.

To answer these questions, current studies should be consulted: e.g., “Industry 4.0 Barometer / Summary 2019” by MHP [9] or the “Market Study Industrial Communication / Industry 4.0” by VDMA / M. Rothhöft [10].

Based on the experiences of HARTING customers in various sub-segments of mechanical engineering and in different countries, there are three aspects that need to be addressed first:

The functions and existing software elements of the initial system must be prioritized:

Key functions that reflect the core competence of the OEM;

Basic functions that apply across the entire system but do not relate to core expertise;

Add-on or auxiliary functions that are of secondary importance to the OEM and the end user and are usually purchased as subsystems;

2. Then gather the expert knowledge of end users (customers) and your own experts about possible digitization projects and give preference to high-priority functions and software elements. Compare this with the expertise of competitors, if possible, and use this to develop a list of requirements. This must be modular in structure throughout and as specific as possible, focusing on prioritized functions with the associated software.

3. The next step is to assess the feasibility of digitization for individual function modules. In this step, it is advisable to involve all of your own OEM experts along the service chain – development & design, project planning & sales, manufacturing & assembly, documentation, service & after-sales services. In addition, evaluations can be obtained from external specialists and any specifications or standards that have already been developed can serve as a template (e.g., from umati). Remember the phrase: “We will definitely remain machine builders and will not become a software company.”

The biggest challenges for OEMs

The contradiction between the diverse individual requirements of customers for machines and the economic necessity of keeping the number of modules/processes required for this (especially for key functions) small. OEMs are already solving this problem today by consistently “breaking down” their systems into logical units and modularization. In order to act economically in this area of digitalization, the following should be taken into account.

As much existing technological and machine-related data as possible should be used and aggregated at the “lowest” modular level in the context of future digitalization projects, i.e., existing sources, data, and machine and process models that are already available should be used. Particular attention should be paid to the previously unused or underused “intelligence” of automation components such as drives, sensors for machine or process states, etc.

At all higher levels (edge and above), the focus should be on physical interfaces with standards that are as open and future-oriented as possible, as well as the latest software and communication protocols.

Overly ambitious and vaguely defined goals, coupled with excessive expectations regarding the economic effects of digitalization, lead to frustration. On the one hand, relevant projects are often overloaded with expectations on the part of OEM management, but on the other hand, they are not provided with sufficient resources. For the development, implementation, and ongoing support of digitalization projects, it is therefore advisable not to try to achieve everything at once.

Rather, the following applies:

Subprojects should be defined on a module-by-module basis and focus on high-priority key functions.

The design of interfaces at the physical level and at the data level should be as state-of-the-art as possible and open to subsequent software updates and enhancements (especially for end users).

The participants should be divided into interdisciplinary project groups so that, on the one hand, a constant dynamic exchange of information can take place and, on the other hand, access to the OEM's management level for the purpose of target correction is possible at any time at short notice.

The overriding rule is therefore:

If the modularity of the digitization projects (the “software”) follows the modularity of the machines and systems (the “hardware”) and is equipped with the latest physical and data interfaces, then as an OEM you have a system that is economically and technically optimally designed for current customer requirements.

This system is then also optimally equipped to cope with constantly growing and, in some cases, as yet unknown future requirements.

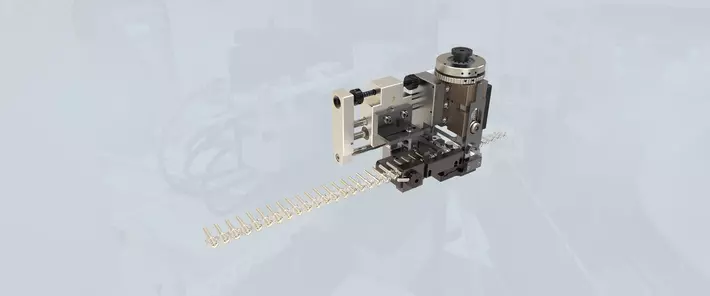

Interfaces play an important role in modular networked production systems: they are the “lifelines, nerve pathways, and synapses” and create the necessary infrastructure for module and machine transitions, the edge area, the factory, and other higher levels. The HARTING Technology Group provides solutions for all interfaces required in modern and future control, drive, HMI, and communication technology for production systems in order to implement and continue digitalization in this area without functional restrictions.

References

M. Bode, F. Bünting, K. Geißdörfer, "Rechenbuch der Lebenszykluskosten" (Life Cycle Cost Calculation Book), VDMA Verlag, ISBN 978-3-8163-0617-7

G. Dueck, "Heute schon einen Prozess optimiert?" (Have You Optimised a Process Today?), 2020, Campus Verlag, ISBN 978-3-593-51084-2

Jürgen Dispan, Martin Schwarz-Kocher, "Digitalisierung im Maschinenbau" (Digitalisation in Mechanical Engineering), 2018, Hans Böckler Foundation, Düsseldorf

IMPULS Foundation, VDMA; Study "Digital-Vernetztes Denken in der Produktion" (Digital Networked Thinking in Production), November 2016, Karlsruhe

Commerzbank AG, Industry Report "Maschinenbau in Deutschland" (Mechanical Engineering in Germany), 2019, Frankfurt am Main,

Industry Report Commerzbank AG VDI/VDE status report "Digitale Chancen und Bedrohungen – Geschäftsmodelle für Industrie 4.0" (Digital opportunities and threats – business models for Industry 4.0), May 2016

T. Huber, A. Henkel, MHP Management and IT Consulting Ltd. "Industrie 4.0 Barometer, Zusammenfassung 2019" (Industry 4.0 Barometer, Summary 2019)

Industry 4.0 Barometer, Summary 2019 M. Rothhöft, VDMA "Marktstudie Industrielle Kommunikation / Industrie 4.0" (Market Study Industrial Communication / Industry 4.0), VDMA Electrical Automation Association

Jakob Dueck

Position: Industry Segment Manager Machinery

- Department: Industry Segment Management

- Company: HARTING Technology Group